Cash vs Card Decision Tool for India Travel

Recommended Payment Approach

Based on your inputs, we recommend:

- Carry ₹5,000–₹7,000 in cash for small towns and rural areas

- Use a credit/debit card for major cities and hotel bookings

- Load a prepaid travel card with ₹8,000 for mixed spending

- Utilize UPI apps for quick transactions in cities

Remember to split your cash across multiple wallets and keep a backup card for emergencies.

| Factor | Cash | Cards | UPI |

|---|---|---|---|

| Acceptance in Rural Areas | High | Low | Very Low |

| Convenience in Cities | Medium | High | High |

| Exchange Rate Fees | None | 2–4% | Usually 0–1% |

| Security | Risk if not stored safely | Remote blocking | Protected by PIN/biometrics |

| Tip-friendly | Excellent | Often requires cash | Not common yet |

| ATM Availability | N/A | Widely supported | Depends on linked account |

Planning a trip to India and wondering whether you should load up on notes or rely on plastic? The answer isn’t black‑and‑white, but understanding how money works across the subcontinent will save you time, stress, and a few extra rupees.

Quick Takeaways

- Carry some cash in India for small‑town markets, train stations, and tipping.

- Major cities accept credit/debit cards and UPI apps at hotels, restaurants, and malls.

- ATMs are plentiful in urban areas but can be scarce in remote regions.

- Keep a backup card and a prepaid travel card for emergencies.

- Know the exchange rates and avoid dynamic‑currency conversion fees.

Cash in India is a physical form of the Indian rupee (₹) that travelers use for day‑to‑day purchases, transport, and tips. While digital wallets dominate big‑city commerce, notes and coins still rule the market in villages, street stalls, and many public transport hubs.

Why Cash Still Matters

Even in 2025, about 30% of Indian retailers don’t accept cards or QR‑based payments. Small eateries, spice markets, and rural dhabas often display a sign that reads “Cash Only.” If you arrive at a bustling spice bazaar in Delhi without any notes, you could miss out on bargaining power and end up paying higher prices.

Cash also makes tipping straightforward. While many hotels have a tipping jar at reception, it’s far easier to slip a few rupees to a porter or a tuk‑tuk driver the moment they help you.

Digital Payments and Card Acceptance

Credit Card is a plastic payment instrument issued by banks that lets you borrow funds up to a pre‑approved limit. In Tier‑1 cities like Mumbai, Bengaluru, and Hyderabad, most five‑star hotels, upscale restaurants, and shopping malls accept Visa, Mastercard, and American Express without a hitch.

Debit Card is a bank‑linked card that draws directly from your checking account. Indian ATMs recognize most international debit networks (VISA/Plus, MastercardCirrus), making cash withdrawals easy when you’re in metro areas.

Beyond cards, India’s home‑grown UPI (Unified Payments Interface) has exploded into a nationwide payment backbone. Apps like Google Pay, PhonePe, and Paytm let you scan QR codes or send money instantly, provided the merchant has a UPI ID. Tourist‑focused apps such asRazorpayXalso enable you to load a virtual balance in rupees and pay without a physical card.

ATMs: Where to Find Them and How to Use Them

Indian ATMs are automated cash dispensers operated by banks like State Bank of India, HDFC, ICICI, and private players such as Axis and Kotak. In cities, you’ll find an ATM every few blocks, often inside shopping centers or near railway stations.

In smaller towns, ATMs tend to cluster around bank branches. If you plan to venture into the Himalayas, the Ladakh region, or the tribal pockets of Odisha, check the latest ATM locator on your bank’s website before you go. Bring a spare card - machines can be temperamental, especially during power cuts.

Currency Exchange: Getting the Best Rate

Airport kiosks and hotel desks offer convenience but charge a 5-7% markup over the mid‑market rate. Better options include:

- Authorized money‑change shops in city centers - they usually quote rates within 1-2% of the interbank rate.

- Pre‑paid travel cards (e.g.,HDFC TravelCard) loaded in your home currency and converted at a locked rate.

- Online platforms likeWiseorRemitlythat let you lock the exchange rate a few days in advance and pick up cash at partner locations.

When using a credit card abroad, choose the “local currency” option at the point of sale. Selecting “USD” triggers dynamic‑currency conversion, which can add an extra 3-4% fee.

How Much Cash Should You Carry?

There’s no one‑size‑fits‑all answer, but a practical rule of thumb is:

- ₹2,000-₹3,000 for daily expenses in major cities (breakfast, metro, small snacks).

- ₹5,000-₹7,000 if you’ll spend a night in a small town or take a local train where ticket counters are cash‑only.

- Leave a larger reserve (₹10,000‑₹15,000) in a secure hotel safe for emergencies or big purchases.

Split the cash into multiple wallets or pockets - losing one pouch won’t leave you stranded.

Safety Tips for Handling Money

India is generally safe for tourists, but petty theft can happen in crowded spots. Follow these quick habits:

- Use a money belt or hidden pouch under your shirt.

- Avoid flashing large bundles; count your money discreetly.

- Keep a digital copy (photo) of your passport, cards, and a note of the emergency contact numbers of your bank.

- If an ATM keeps your card, report it immediately via the bank’s helpline - most banks have 24/7 support.

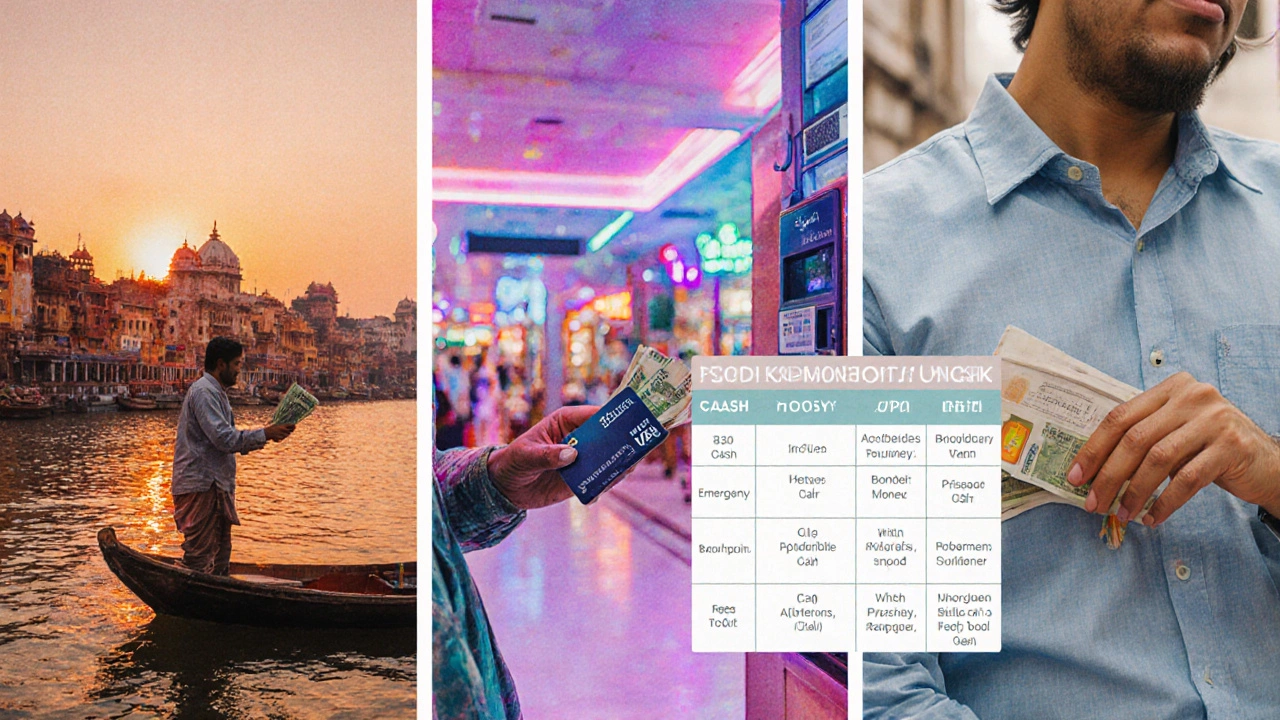

Cash‑vs‑Card Decision Matrix

| Factor | Cash | Credit/Debit Card | Mobile/UPI |

|---|---|---|---|

| Acceptance in Rural Areas | High | Low | Very Low |

| Convenience in Cities | Medium | High | High |

| Exchange Rate Fees | None (use local currency) | 2‑4% if foreign‑currency conversion | Usually 0‑1% on platforms |

| Security (loss/theft) | Risk if not stored safely | Can be blocked remotely | Protected by PIN/biometrics |

| Tip‑friendly | Excellent | Often requires cash for tips | Not common for tipping yet |

| ATM Availability | N/A | Widely supported in cities | Depends on linked bank account |

Real‑World Scenario: 7‑Day North India Itinerary

Imagine you’re traveling from Delhi to Varanasi, then on to Jaipur. Here’s how you’d allocate money:

- Day1‑2 (Delhi): Use a credit card for hotel and metro. Keep ₹3,000 cash for street food and a guide.

- Day3‑4 (Varanasi): Most ghats and boat rides are cash‑only. Withdraw ₹5,000 from an ATM near the railway station.

- Day5‑7 (Jaipur): Mix of card‑friendly malls and cash‑only bazaars. Load a prepaid travel card with ₹8,000 and keep a backup debit card.

By the end of the trip you’ll have spent roughly 60% of your cash on meals, transport, and souvenirs, while the card covered larger hotel bills and online bookings.

Frequently Asked Questions

Do Indian shops accept foreign credit cards?

Major chains, hotels, and upscale restaurants accept Visa, Mastercard, and sometimes American Express. Small shops, market stalls, and many taxis still prefer cash.

Is it safe to carry a lot of cash?

Better to split cash across different pockets and use a hidden money belt. Keep a backup card and a photocopy of important documents in a separate location.

What’s the best way to avoid ATM fees?

Choose a bank that offers free international ATM withdrawals or one that reimburses fees. Some Indian banks waive fees for foreign cards on select ATMs.

Can I use UPI apps with a foreign bank account?

Most UPI apps require an Indian mobile number and a linked Indian bank account. However, you can add a virtual Indian account via services likeWiseorPayoneerto top up a UPI wallet.

Should I exchange money before arriving in India?

A modest amount (≈$50‑$100) in rupees helps with the first taxi or train ticket. Better rates are available in city‑center exchange bureaus or via prepaid travel cards.

Bottom line: bring enough cash to cover low‑tech situations, but let cards and mobile wallets handle the bulk of your expenses. With the right balance, you’ll glide through India’s bustling markets, serene temples, and glittering metros without a hiccup.